Lease or Finance a Car in Canada: Why Financing Wins

Lease or Finance a Car in Canada: Why Financing Wins

Posted on May 15, 2024

When the time comes to acquire a new vehicle, Canadians are often faced with the decision of whether to lease or finance. Both options have their merits, but choosing the right one depends on various factors unique to your situation.

This article will guide you through the key considerations to help you make an informed choice between leasing and financing a car.

The Cost Factor

One of the primary factors to consider when deciding between leasing and financing is the cost. Leasing typically requires lower upfront payments and monthly installments compared to financing.

This can be appealing to those looking to conserve immediate cash flow or reduce monthly expenses. However, it's important to note that at the end of a lease, you don't own the car, and you might need to start the process anew.

Ownership and Equity

One of the main advantages of financing a car is the eventual ownership and equity you build. With each monthly payment, you're working towards owning the vehicle outright.

This ownership comes with the freedom to modify the car as you wish and without mileage restrictions.

On the other hand, leasing provides temporary possession and often includes strict mileage limits, which might not suit those with long commutes or road trips planned.

The Depreciation Factor

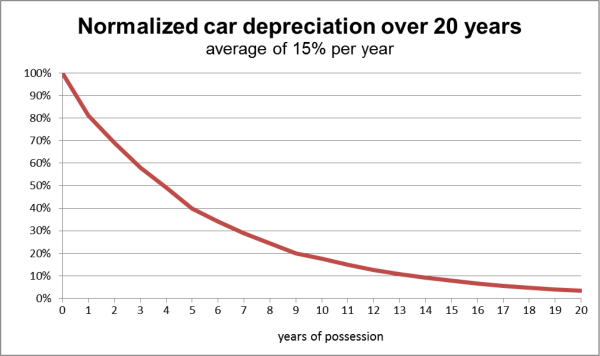

The rate of depreciation can significantly impact your decision. Cars generally lose value over time, and this can affect your investment in the vehicle. Leasing, however, often comes with stricter mileage limits to counter the effects of depreciation.

If you're someone who tends to put a lot of miles on their vehicle, leasing might not be the best choice due to potential overage charges.

The Flexibility Advantage

Flexibility is another aspect that deserves careful consideration. Leasing contracts often come with penalties for early termination or excessive wear and tear.

If your circumstances change unexpectedly, like a job relocation or an expanding family, the inflexibility of a lease might be a disadvantage.

Financing, on the other hand, offers more flexibility since you're the owner, allowing you to make decisions about the car's usage and future without contractual limitations.

The Long-Term Perspective

Thinking about the long-term is crucial when deciding between leasing and financing. While leasing might provide lower monthly payments, it's a perpetual cycle – lease ends, you return the car, and lease a new one.

Financing, however, leads to eventual ownership, and once the loan is paid off, you're free from monthly payments. This can be a major financial relief, especially if you're struggling with credit or financial issues.

The Clear Winner: Financing

In the realm of car acquisition, the choice between leasing and financing is a pivotal one for Canadians. Both options have their advantages, whether it's the cost savings of leasing or the ownership benefits of financing.

However, the long-term view often leans in favor of financing. Not only does it lead to eventual ownership and equity, but it also offers more flexibility and freedom in the way you use and modify your vehicle.

While leasing might be tempting due to its initial affordability, especially for those with credit or financial challenges, the benefits of financing, including the opportunity to build equity and overcome those challenges over time, make it a more solid choice.

So, when faced with the lease-or-finance dilemma, consider your long-term goals and financial situation, and make a decision that aligns with your aspirations.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.