Buying or Leasing a Car in Ontario: What's the Better Option?

Buying or Leasing a Car in Ontario: What's the Better Option?

Posted on April 23, 2024

Leasing or buying a car are the two main avenues towards driving a new car. Both have their upsides and downsides and will be more suitable in some situations than others. Our auto loans team is going to try to help you make a more informed decision about whether to lease or buy your next car by outlining the pros and cons of each!

Pros of Leasing a Car

- Lower Monthly Payments: As you’re only paying the rental and depreciation and not the asset, leases cost less per month than a loan. That difference is gradually narrowing but it’s true right now.

- Access to New Cars: If you like driving new cars, leasing can be a cost-effective way to do it. Leases typically run for 2-3 years before you switch it out for another new car.

- No Maintenance Stress: Most leases can include repairs and servicing as part of the deal. That means zero worries about servicing, repairs, or most running costs.

- More Expensive Cars: The lower cost of leasing means you could lease a car you may not be able to afford if you tried to buy it.

Cons of Leasing a Car

- No Ownership: You’re paying out each month but don’t actually own anything at the end of it. You’re not buying an asset, you’re renting one.

- Can be More Expensive: Many leasing companies provide great value but not all do. We have seen some lease deals that are more expensive than buying a car!

- End-of-Lease Fees: The majority of leasing companies view the end-of-lease inspection as a way to make a little more money out of you. Almost everyone ends a lease with a bunch of fees and they can work out expensive.

- Mileage Limits: Many leases include mileage limitations. If you don’t drive far, these won’t matter but if you drive for work or pleasure, you have to watch your mileage or pay at the end of the lease.

Pros of Buying a New Car

- Ownership: You’re buying an asset and while it’s a depreciating asset, it will still be worth something at the end of the loan. It’s good to have a solid return on your investment!

- Future Trade in: This car acts as a trade in on your next car. Once paid off, you have a tangible asset you can sell for a down payment or use as a trade in on your next purchase.

- No Fees or Mileage Limits: The car is yours to drive as you like with no limitations on where you can drive or how many miles you can do.

Car loans are easier to qualify for: If you have bad credit or a less than perfect payment history, you will usually find a secured auto loan easier to get than a lease.

Cons of Buying a New Car

- Higher Cost Per Month: Buying a car is more expensive per month than a lease. You’ll need to budget more each month to be able to afford it.

- Down Payment: While leases demand a few months upfront, it is usually much less than you’ll need for a down payment. The higher the purchase price, the higher the down payment you’ll need.

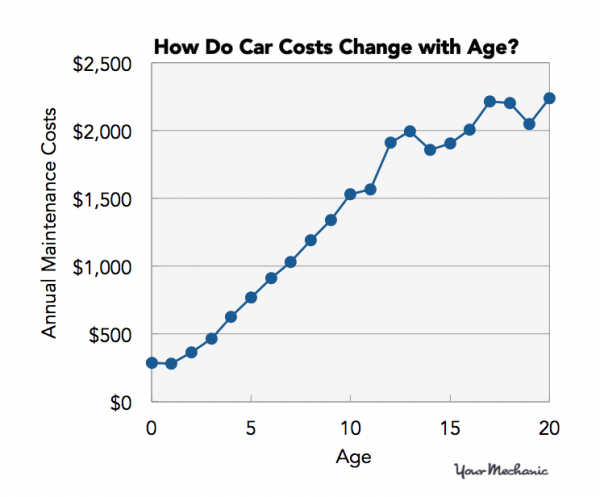

- Maintenance and servicing: Once the free servicing period has run out, running costs are all down to you. While it won’t be much to begin with, the older the car gets the more expensive keeping it on the road gets.

- Depreciation: All cars depreciate but it is definitely something you have to factor into a new car purchase. You’ll be upside down for a while but things will even themselves out eventually.

When you’re ready to lease or buy your next car, get in touch with the auto loan experts at Northway Ford for great deals on auto finance.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.