Finance Or Pay Cash For a Car: Which Option Is Better For You?

Finance Or Pay Cash For a Car: Which Option Is Better For You?

Posted on July 21, 2023

When it comes to purchasing a car from a dealership, buyers are often faced with the choice of paying cash upfront or opting for financing options.

Both approaches have their advantages and considerations, and the decision ultimately depends on your financial situation, personal preferences, and long-term goals.

In this article, we will explore the pros and cons of paying cash or financing a car from a dealership, helping you make an informed decision.

The Benefits of Paying for a Car With Cash

1. Avoiding Interest and Debt: Arguably the most significant advantage of paying cash is the avoidance of interest charges and debt.

By paying the full purchase price upfront, you eliminate the need to borrow money from a lender, resulting in immediate ownership and no long-term financial obligations.

2. Negotiating Power: Cash buyers often have stronger negotiating power when it comes to price. Dealerships may be more inclined to offer discounts or additional incentives when they know they will receive the full payment in one go.

This can help you secure a better deal and potentially save money on the overall purchase price.

3. Simplified Ownership: Paying cash means you own the vehicle outright from the moment of purchase.

There are no monthly payments, and you have the freedom to modify, sell, or trade-in the car whenever you desire without any financial restrictions or limitations.

The Benefits of Financing a Car Loan

1. Preserving Cash Flow: Opting for financing allows you to preserve your cash flow, making it more manageable to handle other financial obligations and unexpected expenses.

Instead of making a significant one-time payment, you can spread the cost over a period of months or years, allowing you to keep more money in your bank account.

2. Building Credit History: Financing a car provides an opportunity to build or improve your credit history. By making regular, on-time payments, you demonstrate your ability to handle credit responsibly, which can positively impact your credit score.

This can be particularly beneficial if you're looking to secure future loans, such as a mortgage.

3. Access to Better Cars: Financing a vehicle can provide access to a wider range of options. Rather than being restricted to the cash you have on hand, financing allows you to choose a higher-priced model or a vehicle with additional features that may have been out of reach otherwise.

Considerations for Both Options

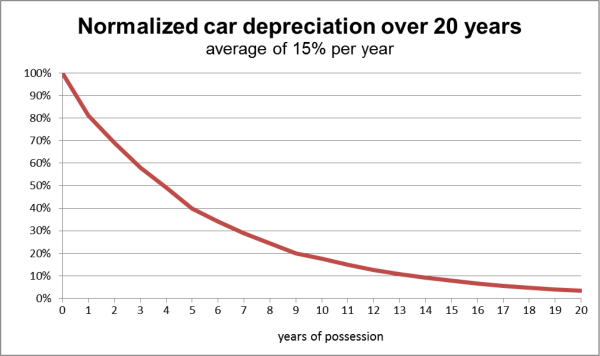

1. Depreciation: Regardless of whether you pay cash or finance for a car, keep in mind that cars typically depreciate in value over time. If you pay cash, the depreciation affects your investment directly, while financing spreads the depreciation risk over the loan term.

Be aware of this factor when considering the long-term financial implications of your decision.

2. Future Financial Goals: Consider how paying cash or financing a car aligns with your future financial goals. If you have other financial priorities, such as saving for a down payment on a home or building an emergency fund, paying cash may delay these goals.

Financing, on the other hand, allows you to manage your cash flow effectively and pursue multiple objectives simultaneously.

3. Insurance and Maintenance: Whether you pay cash or finance, remember that insurance and maintenance costs are ongoing expenses associated with car ownership.

Factor these costs into your decision-making process, as they will influence your overall budget and financial commitments.

At the End of the Day, It Depends

Deciding whether to pay cash or finance a car from a dealership is a personal choice that should be based on your financial circumstances, preferences, and long-term goals.

Paying cash provides immediate ownership, eliminates interest charges, and offers negotiating power, while financing allows you to preserve cash flow, build credit, and access better vehicles. Consider the pros and cons of each approach, as well as your financial priorities, before making a decision that aligns with your needs and aspirations.

Remember, the choice you make will have an impact on your financial well-being and the overall car ownership experience.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.