Do Car Loans Help Build Credit? Accelerate Your Credit Journey

Do Car Loans Help Build Credit? Accelerate Your Credit Journey

Posted on August 18, 2023

A robust credit profile opens doors to favorable interest rates, better loan terms, and increased borrowing power.

While there are several methods to build credit, one often-overlooked avenue is the utilization of car loans.

In this article, we'll delve into the nuances of how car loans can help build credit for Canadians, highlighting the key factors to consider and the potential impact on credit scores.

Understanding Credit Scores

Before delving into the specifics of how car loans influence credit, it's important to have a solid understanding of credit scores.

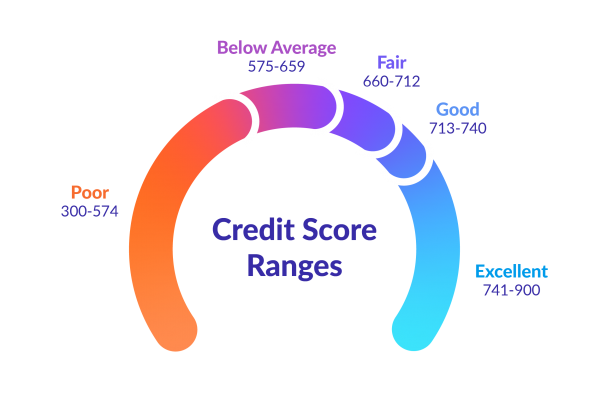

In Canada, credit scores typically range from 300 to 900, with higher scores indicating better creditworthiness.

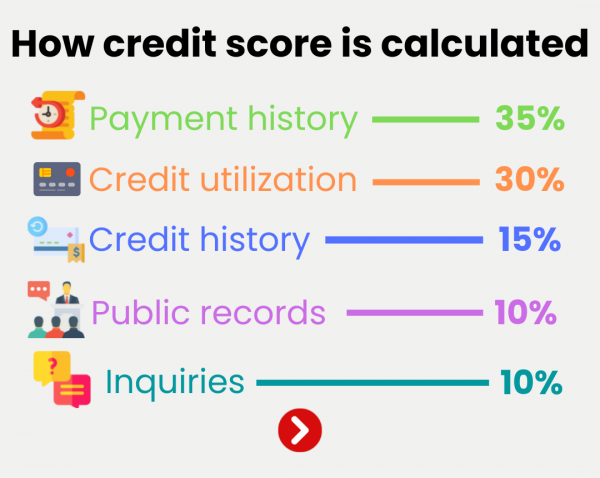

These scores are calculated based on various factors, including payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries.

Positive Payment History

One of the most significant ways car loans can contribute to building credit is through the establishment of a positive payment history.

Timely payments are a crucial component of a healthy credit score. When you make consistent and on-time payments toward your car loan, it demonstrates your reliability as a borrower.

Lenders report these payments to credit bureaus, which then incorporate them into your credit report. Over time, a pattern of responsible payments can have a positive impact on your credit score.

Credit Mix and Types of Credit

Credit scoring models also consider the variety of credit accounts you have. Having a mix of credit types, such as installment loans (like car loans) and revolving credit (like credit cards), can enhance your credit score.

When you add a car loan to your credit profile, it diversifies your credit mix, potentially resulting in a higher credit score. This reflects your ability to manage different types of credit responsibly.

Credit Utilization

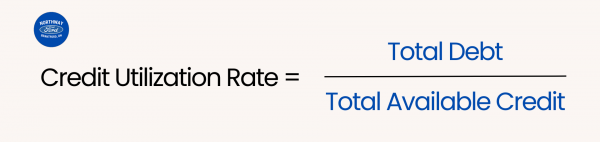

While car loans are installment loans and do not directly affect credit utilization (the ratio of your credit card balances to their limits), they indirectly impact this factor.

By positively influencing your credit score through responsible car loan payments, you may be better positioned to manage credit card debt effectively.

A higher credit score may lead to increased credit limits, which, in turn, can help maintain a lower credit utilization ratio.

Length of Credit History

The length of your credit history plays a role in determining your credit score. As you continue to make payments on your car loan over time, the loan's age increases, contributing to the length of your credit history.

A longer credit history can enhance your creditworthiness, provided you maintain a positive payment record.

Improvement in Credit Score

The impact of a car loan on your credit score might not be immediately evident. Positive changes in credit scores generally take time to materialize.

Consistent and timely payments on a car loan, along with responsible management of other credit accounts, can lead to a gradual improvement in your credit score.

It's important to note that other factors, such as derogatory marks or missed payments, can counteract the positive effects of a car loan.

Do Car Loans Help Build Credit?

In conclusion, car loans can indeed play a significant role in building and improving your credit score in Canada.

By establishing a positive payment history, diversifying your credit mix, indirectly affecting credit utilization, and contributing to the length of your credit history, car loans offer a multifaceted approach to strengthening your creditworthiness.

As you embark on the journey of using a car loan to build credit, remember that responsible financial management across all aspects of your financial life is key to achieving a robust credit profile.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval