600 Credit Score Car Loans: Yes, You Can Still Get Approved

600 Credit Score Car Loans: Yes, You Can Still Get Approved

Posted on April 17, 2023

If you have a 600-credit score and want to get a good car loan in Ontario, you are in the right spot. By the time you reach the end of this conversation, you are going to be in a position of total confidence.

Why Do You Have a Credit Score of 600?

The first question that we need to address is what is the root cause of your 600 credit score. That score is considered low, and you will have a tough time securing a competitive car loan.

You should sign up with Credit Karma to find out what your credit score is and identify the cause of your credit issues.

With a credit score of 600, it's likely that you have some accounts that are either past due or in collections.

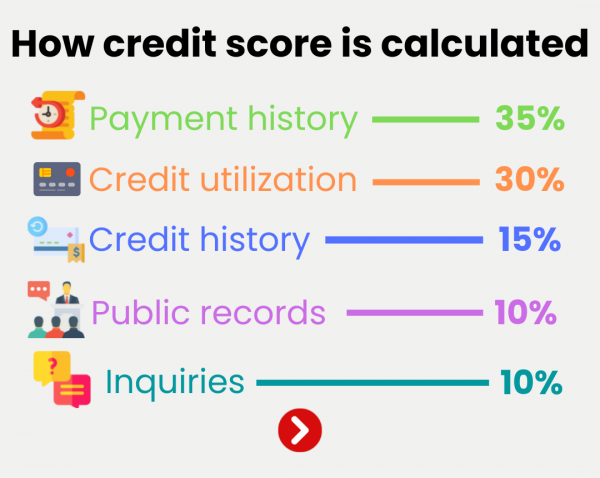

There are many variables that go into calculating a credit score. Credit scores do range from 300-to 800, depending on which scoring model is being used.

TransUnion and Equifax each have their own distinct scoring models so that you could have a 600 credit score with one firm and 650 with another firm.

When you have access to your credit report, you should look for accounts that have derogatory comments. Missing a single payment will send your credit score downward, even if the payment was only for a few dollars.

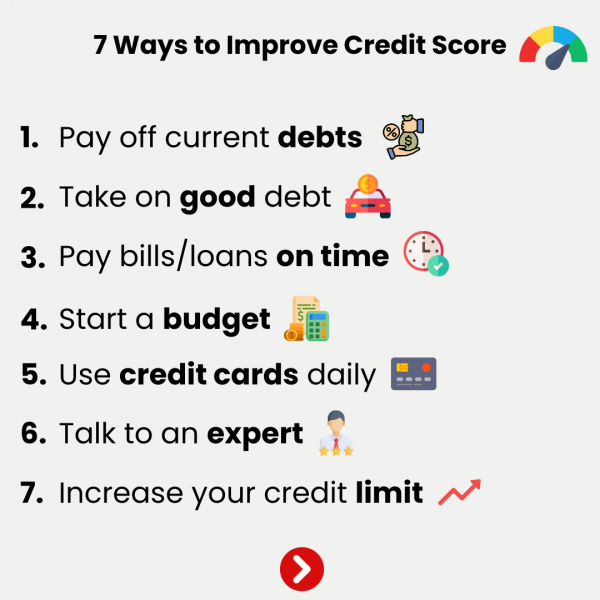

Since your credit score is in the 600 range, you must have a few accounts that are seriously past due. Make it your top priority to bring these accounts up to date while still paying your existing debts. It's much easier to get a car loan with a credit score above 600.

Avoid Credit Repair Programs

There are credit repair programs being advertised online. While they make sensational claims, you should not use these services because they are the modern age snake-oil salesperson.

To rebuild your credit, you just need to stick to the fundamentals of paying your bills on time and making at least the minimum payments. Click here to learn more about building your credit score.

If you follow that approach, your credit score is going to bounce back; it will take some time, though.

Where to Finance a 600 Credit Score Car Loan

You can access car loans with a 600 credit score, but the interest rates that these lenders are going to quote will be high. Instead of trying to navigate the car loan industry on your own, there is an easier way.

You should reach out to a car dealership in your community; these dealerships already have relationships with lenders across Canada who offer loans to borrowers with a credit score of 600 or lower.

The dealership also has people who provide credit rebuilding advice that will help you repair the damage that was done to your credit.

It will take some time for your credit score to improve, but the dealership will get you approved at the most competitive terms if you need a car right away.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.